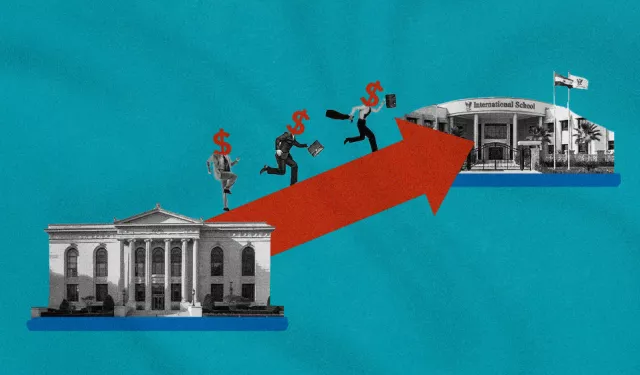

Education on credit: School loans sustain middle-class aspirations

At a restaurant checkout, two women with their daughters are waiting to pay. Before the cashier tells them how much, one asks her daughter to work it out, calling her “a calculator.” The girl impresses everyone with her accuracy, but the mother breaks down in tears when she reflects on the fees of her daughter’s “British” school.

This scene comes from an advertisement by a consumer finance company offering loans for school fees. Viewed by an estimated three million people, it captures the anxiety many parents experience with each academic year and offers tuition loans as a solution.

Although still a small fraction of Egypt’s consumer credit market, education loans have gained momentum in recent years, according to two sources in the sector. Escalating private school fees have transformed education financing into one of the most dynamic growth areas in consumer lending.

Searching for solutions

The Ministry of Education’s 2024 regulations cap annual fee increases at private schools. Even so, annual tuition at private schools that follow the national curriculum ranges from below 5,000 pounds (about $100) to 35,000 ($700) and above, while international school fees start at 30,000 pounds ($600).

Publicly available figures show that some private schools charge tens of thousands of pounds per year. International schools often demand several hundred thousand pounds, and in some cases fees exceed one million pounds (about $20,000).

| School | Fees |

| Cairo American College (CAC) | $14,450 to $27,600 |

| New Cairo British School | EGP 495,100 to 906,900 |

| Lycée Français du Caire | EGP 257,500 to 373,700 |

| Nermien Ismail Schools | EGP 97,300 to 194,400 |

| Majesty International School | EGP 75,000 to 141,000 |

Badawy Allam, head of the Private Schools Owners Association, told Al Manassa that schools within their network classed as the most expensive currently charge between 300,000 and 350,000 pounds annually (about $6,000–$7,000). Still, he noted that “around 80% of private schools charge no more than 50,000 pounds ($1,000).”

Successive waves of inflation since 2022 in a country where the minimum wage does not exceed 7,000 pounds have intensified the burden. Schools that set fees in foreign currency have become especially costly after repeated currency devaluations.

Private schools have become the go-to solution for many middle-class families who, in their ambition to secure a better education for their children than the state provides, accept the higher costs. This leaves them with little alternative but to rely on installment plans.

A World Bank report confirms that inflation has eroded the capacity of middle-class households to absorb steep tuition increases, particularly as food prices—the largest single component of household spending—continue to rise.

“It’s not only middle-income families. Even wealthier segments are now turning to installment plans after the latest devaluations,” said Ahmed Osama, managing director of Drive, a nonbank finance company.

Evidence of the strain is clear. Data from the 2019/2020 CAPMAS income and expenditure survey showed average household spending on education was 8,850 pounds annually, accounting for 12.5% of total spending. Those figures predate both the COVID-19 pandemic and subsequent inflationary shocks.

The Financial Regulatory Authority reports that most nonbank consumer lending still targets automobiles, appliances and electronics. Yet an executive at consumer finance company Aman told Al Manassa that education loans are a nascent, fast-growing category.

“The sector is attracting increasing attention, though it still represents less than 3% of the consumer finance market,” said the executive, who requested anonymity.

Said Zater, vice chair of Contact Financial Holding, added that demand has broadened. “In recent years, financing has expanded beyond school tuition to cover graduate studies and specialized training programs,” he said.

Fierce competition

Banks and consumer finance companies now compete directly for tuition lending. Each appeals to different customer segments.

The executive at Aman emphasized that the application process with consumer finance companies is easier, making them attractive to families unable to demonstrate income formally. They also pride themselves on speed.

“A client can secure approval within two days once the paperwork is complete. At banks, the process can take up to three weeks, with site visits and detailed checks,” the Aman executive explained.

Non-bank consumer finance remains relatively new in Egypt. The sector was formally established through a legal framework in 2020, and 45 licensed companies now operate. Osama explained that their rates, currently beginning at 25% on a reducing balance, are typically three to five percentage points higher than banks because they borrow funds from banks before lending to clients.

Banks, however, retain advantages in scale and pricing. A senior credit management officer at the National Bank of Egypt told Al Manassa that banks can extend education loans up to 9 million pounds ($187,500) with interest rates roughly five percentage points lower than those of finance companies, albeit with more demanding procedures.

Mohamed Abdel Aal, board member of EG Bank, added that some banks reduce rates by two to three percentage points if they have direct agreements with schools or universities. Others provide installment options through Visa credit cards at zero interest for periods of less than one year.

Schools themselves now offer installment schemes, allowing parents to pay fees over three, eight or 12 months directly to the institution.

Osama argued that direct school-based plans are most advantageous, since they avoid additional interest. But he acknowledged limitations: many schools only divide fees into two installments, which creates large, concentrated payment demands—particularly at institutions with high tuition.

The competition among banks, finance companies, and schools underscores the accelerated privatization of Egypt’s education sector. More than 2.5 million students have exited low-cost public schools. Confronted with inflation, parents increasingly rely on financing to cover tuition bills that can rival the cost of a car—or even a modest home.